COVID – 19(Corona Virus) is an infectious disease caused by a new virus. The outbreak of the coronavirus has been labelled a pandemic by the World Health Organization (WHO). In order to control the spread of the deadly virus, the Indian government has imposed a 21-day lockdown in the country and is urging people to avoid all ‘non-essential’ travel. India’s prime minister ordered all 1.3 billion people in the country to stay inside their homes for three weeks starting 26th March, 2020 — the biggest and most severe action undertaken anywhere to stop the spread of the coronavirus.

The COVID – 19 has affected the GDP of the economies very severely. India’s gross domestic product (GDP) growth could fall below 5% in fiscal year 2021 (FY21), if policy action is not taken urgently, according to the Confederation of Indian Industry (CII). Growth in the third quarter (October-December) slowed down to 4.7% and the impact of the Covid-19 outbreak is likely to pull it down further in the fourth quarter, said the industry body.

Prime Minister Narendra Modi had announced the formation of an economic response task force to help cope with the impact of the outbreak, which has not only disrupted supply chains from overseas, but is also now threatening to impact domestic production, as quarantine measures have restricted the movement of workers.

India’s IT services companies may freeze pay hikes and cut bonuses to deal with the business slowdown sparked by shutdowns due to the Covid-19 outbreak.

India’s technology services firms have asked those employees who can deliver remotely to work from home. They have sent trainees back home from campuses in a bid to keep to social distancing norms and reduce the spread of the virus.

Most India-based IT services firms have eight out of ten employees working in centres locally.

It is no secret that the big four – Infosys, Tata Consultancy Services (TCS), Wipro and HCL Technologies – of the Indian information technology (IT) sector are facing margin pressures and moderation in revenue growth.

The client servicing model is changing and costs are rising. The implementation of the proposed US immigration laws, salary increases (employee costs account for 50-70% of IT companies’ expenses) and cloud over economic recovery of developed economies (a major source of revenue) continue to hit these companies.

This has made stock analysts and market experts look at mid-level IT companies that are available at lower valuations than their larger peers.

Before we explore why mid-cap IT companies such as Mindtree, NIIT Technologies, Hexaware and Persistent Systems are looking more attractive than the larger IT companies, let’s look at what is ailing the IT sector.

Indian IT companies are known for application development and maintenance work and not so much for product development and consultancy. The challenge for them is to upgrade to the latter high-margin businesses to meet the changing needs of clients.

Even though IT stocks have dipped more than expected — 32% on average and 27% on the Nifty IT index — Phillip Capital points out that their valuations are still far from the troughs of 2008. In addition, most of these companies are cash-rich with strong cash flows, offering dividend yields between 2 to 5%.

If and when, the Indian markets recover — it will be led by domestic consumption. Large caps like TCS and Infosys will be the first to recover since their business models are stable and valuations remain attractive. Mid caps will also recover, but it will take a longer gestation period.

Which IT Stocks are beneficial to buy during the Corona virus lockdown?

HCL Technologies shows the most promise with 2% growth estimated even with Corona virus in FY21 and 9.8% in FY22, second only to Infosys.

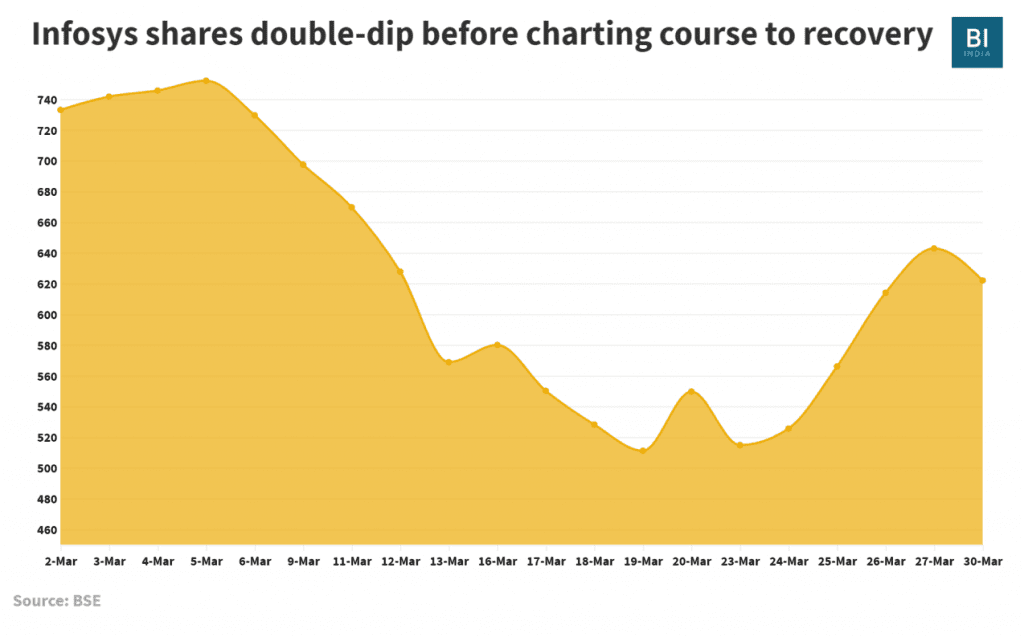

Infosys may be stagnant in the coming financial year but is set to shoot up to 10.1% in FY22.

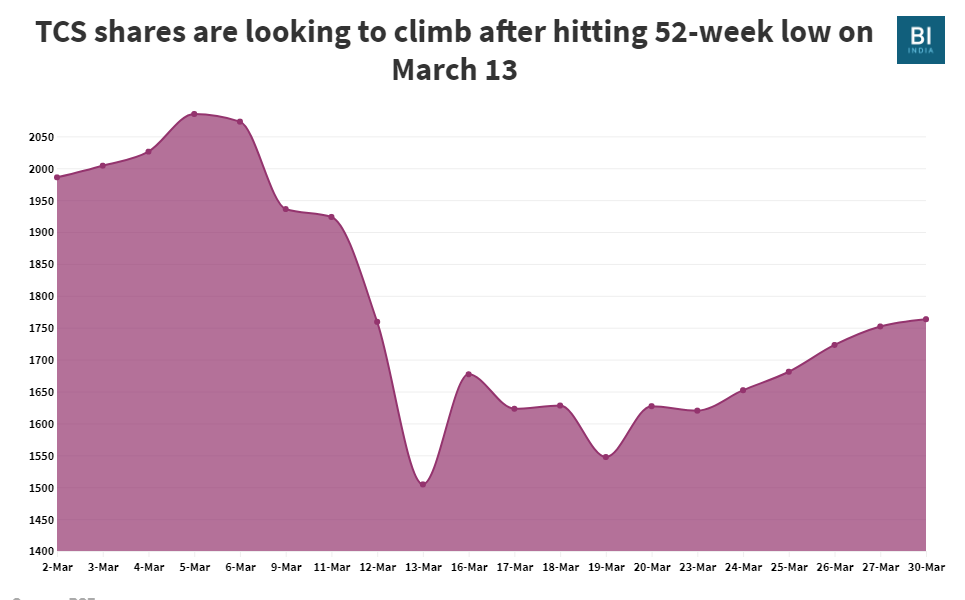

TCS, India’s biggest IT Company, also shows promise is expected to recover in FY22 and hit 9%.

Since deals are being deferred this quarter, they will suffer from weak order inflow during the fourth quarter of 2020. Although revenue may start to grow in the next quarter, the uptake will be slow as order inflow starts to trickle in again.