COVID – 19(Corona Virus) is an infectious disease caused by a new virus. The disease was first identified in 2019 in Wuhan, the capital of Hubei, China, and has since spread globally, resulting in the 2019–20 coronavirus pandemic. The COVID – 19 has affected the GDP of the economies very severely. Due to sudden rapid increase in the virus cases, the Prime Minister of India Narendra Modi has declared complete lockdown till 14th April, 2020. The groceries and pharmaceutical stores are at exception. Due to this lockdown, all the other business enterprises, educational institutes, companies, etc. are facing heavy loss.

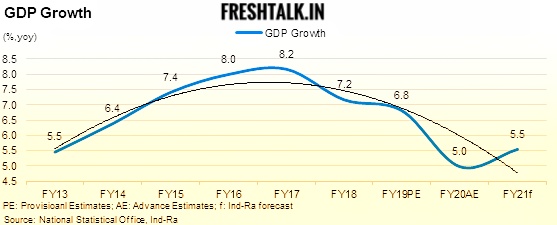

According to the Confederation of Indian Industry (CII), India’s gross domestic product (GDP) growth could fall below 5% in fiscal year 2021 (FY21), if policy action is not taken urgently. Prime Minister Narendra Modi had announced the formation of an economic response task force to help cope with the impact of the outbreak, which has not only disrupted supply chains from overseas, but is also now threatening to impact domestic production, as quarantine measures have restricted the movement of workers.

A recent report of the KPMG says that if COVID-19 escalated in India, the nation may face a growth rate below 3% in FY21.

The name “KPMG” stands for “Klynveld Peat Marwick Goerdeler”. It is a multinational professional services network, and one of the Big Four accounting organizations. Seated in Amstelveen, the Netherlands, KPMG is a network of firms in 147 countries, with over 2,19,000 employees and has three lines of services: financial audit, tax, and advisory. Its tax and advisory services are further divided into various service groups. Each national KPMG firm is an independent legal entity and is a member of KPMG International Cooperative.

According to a recent report of KPMG, it says, “even before the onset of this pandemic, the global economy was confronting turbulence on account of disruptions in trade flows and attenuated growth. The situation has now been aggravated by the demand, supply and liquidity shocks that COVID-19 has inflicted. They expects at this time the course of economic recovery of India will be smoother and faster than that of many other advanced countries. The United Nations Conference on Trade and Development (UNCTAD) in its latest report ‘The COVID-19 shock to Developing Countries’ has predicted that major economies least exposed to recession would be China and India.”

The KPMG report further states, “While we are now focusing in India on securing the population from health hazards and on providing relief, especially to the poor, we also need to think long-term – to secure the health of the economy, the viability of businesses, and the livelihoods of people. Apart from providing robust safety nets for the vulnerable, ensuring job continuity and job creation is the key. Also, there is an urgent need to mobilise resources to stimulate the economy.”

As the world scrambles to ease the immense healthcare burden of the virus, most economies are bracing for the havoc the virus is likely to leave in its wake. Many countries have already announced several rounds of ‘economic packages’ so far to aid businesses, workers and healthcare systems engulfed by the crisis. The Indian government and the RBI have also put in place a slew of measures to help fight the COVID-19 menace and ameliorate its economic fallout.

“The current situation is one that has a deep impact on key segments of the economy and is unlike anything we have seen in recent times. The global nature of the pandemic, coupled with its high intensity and long duration, will fundamentally alter the business landscape through changing trade flows, asset prices and consumption patterns. This will impact all key stakeholders, including banks, financial institutions, investors and corporates. The need of the hour is to put in place a comprehensive action plan that addresses potential impact, from short-term cash flow concerns to longer term balance sheet adjustments”, the KPMG report added.

The KPMG report presented three scenarios to explain the economic effects of COVID-19.

About the first scenario it said, “India’s growth for 2020-21 maybe in the range of 5.3% – 5.7%.”

About the second scenario it said, “India is able to control COVID-19 spread, but there is global recession. India’s growth is expected to be in the range of 4%-4.5%.”

About the third scenario it said, “If the pandemic increases and there is global recession then the economy will have to bear the brunt of both domestic and global demand destruction. Then, India’s growth may fall below 3%.”

The report said steps taken to contain the virus spread such as the nationwide lockdown have brought economic activity to a near-standstill, with impacts on both consumption and investment.